History has exhibited that many of the economic advancements have been in synchronisation with global trends and world events. After World War II, the global economy was in immediate need of a new financial system. The gold standard was too rigid; at the same time, with an inflationary alternative, economists were concerned that countries could devalue their respective currencies to boost exports. On July 1st, 1944, representatives from the United States, Canada, Western Europe, Australia and Japan established the Bretton Woods monetary system, where the respective currencies of the participating states were linked to the US dollar, and the US dollar was linked to gold. In the Summer of 1971, President Nixon announced the end of the Bretton Woods standard. Since which, monetary systems have been sequentially, adapting, growing and evolving. In exemplification, the Dutch empire was superseded by the British, which then fell victim to the American – no monetary system is absolute.

Macroeconomic trend: Coronavirus catalyst

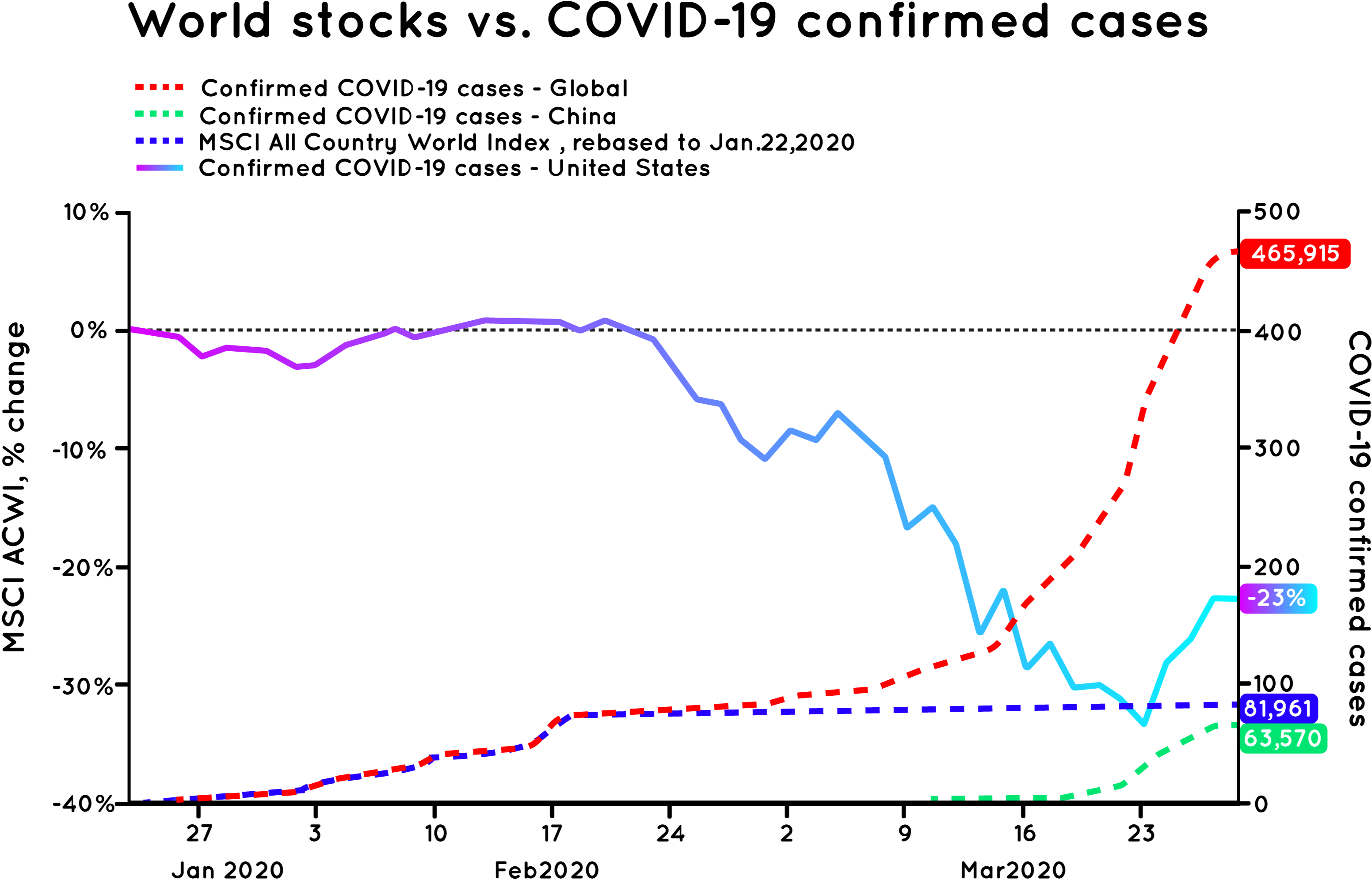

The current-day COVID-19 pandemic has hit the global economy like a tsunami, bringing it to an abrupt halt. Through an answer of panic, governments are responding as they did in the 1930-1945 era; credit-based monetary catalysts coupled with heavy quantitative easing are prime strategies; interest rates are being pushed to 0%; US Treasury is distributing funds to the American population with a view to stimulate consumer spending – many European states are following the precedence. Given the dominance of the US dollar and the Euro, by relative contrast, such distributive policies will leave economic gaps in the rest of the world, specifically, emerging economies that do not have a central bank capable of fulfilling such roles. For the most fragile countries, the pandemic promises to be catastrophic. This economic setback risks plunging millions of people from the emerging middle class back into extreme poverty. Former IMF director, Dominique Strauss-Kahn, has expressed concern for Africa, which displays the highest rates of malnutrition, HIV infection and tuberculosis in the world; such vulnerabilities could make the Coronavirus even more lethal for the continent. In addition, where developed countries can adopt drastic confinement measures, this is often impossible in overcrowded urban slums, where running water is difficult to access, where stopping work to the market for food is not an option (Strauss-Kahn, 2020).

- The economic climate is subject to an array of factors, the economic significance of which, can be reduced to four key driving forces:

- Productive growth (learning, innovation and growth: 1-3%/year)

- Short-term debt cycle (lasts 8-10 years; booms and busts)

- Long-term debt cycle (lasts 50-75 years; new type of /credit is created)

- Politics (domestic/international)

The last long-term debt cycle began in 1945, which followed the demise of the Bretton Woods agreement, sufficing as the trigger of the American world order. In synchronisation with the Coronavirus epidemic, all four of the above cycle are simultaneously converging to a common conclusion. The financial struggle has highlighted the open flaws of the current system; the currently-used fiat system is inefficient. A global depression is becoming seemingly more inevitable. Tools previously used to address recessions, namely, austerity, debt restructuring, wealth distribution, seemingly, are insufficient to find any beneficial utility. The need for a revamped financial system, a new world order, has become evidently apparent.

In the United States, tens of millions of laid off workers, their families and millions of small businesses are in serious trouble; there is no direct method of transferring money to them without potentially disastrous delays. A government that collects money from all its citizens and businesses each year has never built a system to efficiently distribute money when it is most needed by the supposed beneficiaries. COVID-19 is catalysing the financial revolution. Three months after the start of the health crisis, almost half of the world's population is in confinement. The economic demands are shifting. With part of the labour force confined for an indefinite period, it is inevitable that production will fall. Some companies will downsize, others will close resulting in significant job losses; recession indicators are becoming increasingly more apparent. The fall in consumer demand that is not offset by support measures will result in a perpetually short supply; the spiral could lead to fatal consequences. The International Monetary Fund have expressed concerns that the current crisis may result in repercussions significantly worse than the economic collapse in 2008. London School of Economics and Political Science anticipates a double-digit percentage decline in global GDP over the next quarter, with no sights for recovery; consequently, prospective public and private debt sees no limits. Increasingly more businesses are being forced to cease operations under government measures, igniting the first in an economic series of dominos to collapse. Aviation, tourism, leisure activities and non-food retail face an extended period of inactivity. Social unrest seems inevitable; mental health concerns are trending – depression, anxiety and even suicide (Begg, 2020). Households that are committed to payments for rents, utilities and other regular outgoings based on previously credible expectations of a certain level of income will find themselves in financial jeopardy. Many lenders and landlords have shown tolerance, but how long can this last? The obvious question arises: what are the longer-term economic implications of the current health crisis?

Banks are failing to fulfil public needs; they are under financial constraint, caught between their respective governments and the retail market. Central banks and governments need to transmit monetary power to the economic agents, balancing public health and safety. The Bank of England called for a digital solution during the recovery of the 2008 bank-triggered recession. China is responding through its state-run blockchain with a view to offer an array of financial services that banks are now struggling to. The United States is seeking to offer similar solutions by way of Facebook’s Libra project.

International response: a financial revolution

America’s gold reserves offered it a strategic position of strength during the Bretton Woods negotiations. Today however, with the currently-implemented fractional reserve monetary system collapsing, China is seeking to capitalise on the opportunity. The Chinese state has propelled blockchain technology into the international sphere upon founding the Blockchain Innovation Alliance, a collaborative project that brings together more than 100 enterprises, namely, IBM, AliBaba, Huawei and Tencent, with a view to build an open platform for open communication, cooperation and innovation through the utility of blockchain technology.(Peng, 2020)

Through the alliance, China has launched its public service blockchain platform, “Yu Express Chain”, that seeks to serve as a blockchain engine and a development services provider. Once launched, it will be the first global infrastructure network, where companies will be able plug in to the network, choose from one of many enterprise blockchain protocols or public chains, and effortlessly build global applications. “Designed to unify the fragmented market, BSN is a cross-cloud, cross-portal and cross-framework public network that enables developers to easily and affordably develop, deploy, operate and maintain permissioned and permissionless blockchain applications and nodes,” Leon Lu, CEO of Huobi, expresses.

The Chinese state asserts a variety of use cases; namely, smart city applications, whereby internet-connected sensors are used to collect data to better-manage public resources, specifically, energy conservation. Other use cases include identity registration and data storage. In support of such ambitions, China has filed for the most blockchain patents, globally. Following successful launch, the project will expand to Hong Kong and Singapore, among 54 other planned locations. In addition to international unification, another benefit is the network’s low price which will attract SMEs and individuals, further accelerating adoption of blockchain technology. (Zhao and Pan, 2020)

OneConnect, the FinTech branch of China’s largest insurance company, Ping An Insurance, has partnered with a logistics conglomerate, China Merchants Port Group, with ambitions to develop a blockchain-based information sharing platform for the country’s biggest trading hub. The platform will include information from the custom services, port operators, logistics companies, financial institutions and import/export firms to manage information pertaining to trade companies, logistics, contracts and other documents from a single system via shared databases on chain. The blockchain will aid tracking efficiency at a lower cost. Government access will enable state monitoring of international trade. (Pan, 2020)

Blockchain technology its third phase of utility and adoption, by way of which, the world is becoming smaller. This is resulting in significant geopolitical and macroeconomic implications. The financial system is sequentially being reinvented through the innovation of economic and technological world leaders. The current system of fiat-based economics is being challenged through the blockchain revolution.

As the Blockchain Innovation Alliance suggests, China is a leading actor in blockchain-based economic revolution through its innovation in FinTech. In the United States, Facebook’s corporate project, Libra, is set the launch in 2020. Similar to the above described Chinese project, Libra is a decentralised, programmable blockchain that seeks to support low volatility cryptocurrencies with ambitions to serve as an exchange platform for billions of individuals and organisations across the globe. The Libra protocol aims to create an infrastructure with a view to foster innovation, lower barriers to entry, whilst improving access to financial services. In anticipation of a globally-collaborative effort to further the ecosystem, Libra have launched an open-source prototype, Libra Core. Transactions on the blockchain are processed through validators who jointly maintain the database through smart contracts in a new programming language, Move. The blockchain will host a range of stablecoin cryptocurrencies, with international recognition, to further global adoption. Earlier this month, Libra announced that it initiated the licensing process for its formal payment system with the Swiss Financial Market Supervisory Authority, FINMA.

Blockchain: a new world order

Just as the financial dominance of the Dutch and the British diminished, the US dollar will, too. Between such phases of regulation, old patterns of governance have disintegrated with each evolving system. The systems of collective organization are receding; individualism is finding its place, most recently, through blockchain technology. The United States, China and other corporate players are competing with hopes to outpace each other in a view to find first mover advantage; each hold an ambition to establish themselves as a leader of the blossoming financial system. China has invested significantly in Africa. The Far East country is seeking to expand its worldwide reach by way of train lines, shipping routes, roads, ports, pipelines and power grids with a view to find economic integration, goodwill and accelerated development; the project follows on from the old Silk Road, the Belt and Road Initiative that connected Asia, Africa and Europe. The multibillion project holds ambitions to connect 71 countries, accounting for a quarter of the world’s GDP and half of its population. The network seeks to operate via a digital currency, the digital Yuan, yet to be found by the Chinese Blockchain Innovation Alliance, which will give rise to the Chinese Monetary Fund. Through the upcoming platform, the network currency could be the first international digital currency to be adopted by billions across the East. Former IMF director, Dominique Strauss-Kahn expresses concern on China’s global influence, suggesting that the West has compromised its security by allowing China to become the ‘‘factory of the world”, given that a significant portion of the global drug supply is sourced from on China.

Similarly, Facebook owns Instagram and Whatsapp; through its social networks, it has interconnected almost half of the global population. The US dollar is already the currency of international choice, being used in over 70% of transactions across the globe. Libra seeks to bypass the government’s monetary function and connect directly with its users with a view to utilise its prospective digital currency. In furtherance, earlier this month, the company announced the prospective launch of Facebook shops, a platform that enable business owners to conduct trade through Facebook, Instagram, Messenger and Whatsapp, further-expanding adoption with a view to expand the network through utility; Calibra, a Facebook-owned cryptocurrency wallet for Messenger and Whatsapp, will further-perpetuate such ambitions. Google and Apple have united the West via its mobile applications, which source and verify population data, offering the United States a significant advantage by way of the big data network.

A new array of financial services are set to market via the decentralised protocol. The first generation of blockchain offered the world a decentralised ledger. The second generation established Smart Contracts. The third generation will launch decentralised financial services for every layer of the market, opening doors for FinTech and blockchain companies. Debt and lending will be managed via the blockchain and non-custodial wallets; banking will evolve to facilitate decentralised payments, attracting application developers and pertaining businesses. The protocol will support plug n’ play functionality, where third party programs and tools will seamlessly integrate into the network. Know Your Customer and Anti-Money Laundering checks will be digitised. All financial services will be offered via through the infrastructure. China has already announced integration of its network with Ethereum’s blockchain and bitcoin’s lightning network. Nuls, a microservice blockchain project, recently announced development of a protocol bridge that seeks to connect the aforementioned blockchains. The third-generation protocol will open a huge sphere of opportunity (Noble, 2020).

Davoa Capital: a financial opportunity

The FinTech industry has grown exponentially over the last several years. There are over 12,000 FinTech start-ups, worldwide; approximately, 24% of the global population is familiar with blockchain technology. An equity research report issued in March by banking firm, Goldman Sachs, estimated that $4.7 trillion in revenue for financial services firms is at risk of being displaced by new FinTech entrants. Such technological innovation is disrupting the banking sector; namely, cross-border remittance, credit issuance and insurance. Increasingly more people around the world are adopting nomadic tendencies; the globe is being localised through advancements in science and technology. Resultantly, traditional methods of banking are becoming increasingly more limited – banking flexibility is becoming a modern necessity.

The Boston Consulting Group Matrix has identified the growing FinTech sector as ‘Problem Child’ – high growth prospects with limited market share; huge cash generation with greater expenditure. Given the exponential growth, the prospect of becoming a ‘Star’ is plausible. Significant investment by the sector to catapult growth has been made in areas of infrastructure, compliance and customer acquisition. A high cash burn-rate has preserved the Problem Child status. A risk-off cycle has further-catalysed a cash crunch, opening an opportunity to find positive synergies with the DeFi sector through developments in mobile applications, brand identity, protocols and GUI platforms.

Decentralised Finance relies on blockchain technology. Decentralised regulation, whitelisting functionality and Smart-Contract utility are some of the key features that a decentralised ledger offers, enabling process automation, opening an avenue to minimise compliance costs. Such utility would catapult the sector from a Problem Child to a Star. Simplicity, automated compliance and profitability would open the doors to mass adoption. Such a collaboration would give rise revolutionary products and services, attracting profitability. As things stand, blockchain lacks users, a mass-appropriate UI/UX interface, global branding and media support. Furthermore, regulatory compliance remains in its infancy. The above-described collaboration between the two sectors would find significantly positive synergies through the counterweight of respective strengths. This opens the market for Davoa Capital – a performance-driven investment fund

The relaunched financial infrastructure will demand a new array of financial services to strengthen foundational support. The ecosystem will necessitate specialised expertise to further-catalyse growth and adoption. This is where Davoa Capital comes in. Davoa has identified, analysed and understood the macroeconomic multivariable trends a view to support sprouting and established actors. Davoa Capital has developed its expertise in financial systems, financial regulation, FinTech, behavioural finance, management accounting and blockchain technology through a decade of work in asset management and advisory across an array of sectors, supporting entrepreneurs from all walks of business. Davoa Capital is investing in emerging leaders, service providers and protocols that will empower the growth and success of blockchain finance.

Mergers and acquisitions between the FinTech and DeFi are economically inevitable. Davoa Capital identifies and recognises the prospective value in such prospects; the project seeks to lay the foundations with a view to capitalise on such partnerships by way of income generation through plug and play services and market penetration for FinTechs and DeFi protocols, respectively. The Capital Fund is well-connected with economically-active regions of Latin America, Southeast Asia and West Africa. Through targeted marketing and execution of product-market fit strategies, Davoa Capital will connect DeFi protocols with FinTech industries, creating a revenue path. Specifically, Davoa Capital will strategize to focus on FinTech equity, DeFi projects and blockchain protocols.

In slowing economies, the circulation speed of goods and services needs to increase to stimulate the currency flow; by extension, in such places, asset securitization and cryptocurrency tokenization is inevitable; consequently, this will lead to greater adoption and utilisation of synthetic assets and currencies. This will open a market for protocols and platforms to support adoption, as Facebook’s Libra and the Chinese Blockchain Innovation Alliance are doing now.

- References